MP Materials Corp. Common Stock (MP)

61.61

+0.21 (0.34%)

NYSE · Last Trade: Mar 4th, 4:33 PM EST

As of March 4, 2026, Treasury Secretary Scott Bessent has signaled a definitive shift in American economic policy, unveiling a dual-track strategy designed to rewire the domestic economy while exerting maximum pressure on global trade partners. Central to this strategy is the "3-3-3" plan—a bold supply-side framework aimed at

Via MarketMinute · March 4, 2026

NUUK, GREENLAND — In a dramatic pivot that has sent shockwaves of relief through global financial markets, the geopolitical standoff over Greenland has reached a definitive resolution. Following months of aggressive rhetoric concerning territorial acquisition and the looming threat of punitive "Security Tariffs," the United States and its European allies have

Via MarketMinute · February 27, 2026

This company is helping resolve a key strategic rare earth supply chain problem for the U.S.

Via The Motley Fool · February 27, 2026

MP MATERIALS CORP (NYSE:MP) Reports First GAAP Profit Amid Strategic Pivot, Fueled by U.S. Government Agreementchartmill.com

Via Chartmill · February 26, 2026

Data from Stocktwits showed that retail sentiment on SPY has moved to ‘bullish’, while it remained ‘bearish’ on QQQ.

Via Stocktwits · February 27, 2026

MP Materials Corp (NYSE:MP) reports fourth-quarter financial results Thursday after the close. Here are the key highlights from the quarter.

Via Benzinga · February 26, 2026

WASHINGTON, D.C. — Global financial markets are breathing a collective sigh of relief this February 25, 2026, as the dust settles on one of the most volatile periods in recent geopolitical history. Following a tense standoff that saw the White House threaten sweeping "Security Tariffs" on European allies over the

Via MarketMinute · February 25, 2026

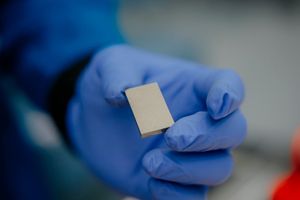

In a move that signals a radical shift in American industrial policy, the Trump administration has officially finalized a $1.6 billion investment package in USA Rare Earth (NASDAQ: USAR), including a direct 10% equity stake for the federal government. The announcement, made through the Department of Commerce on January

Via MarketMinute · February 25, 2026

SANTIAGO, Chile / WASHINGTON D.C. — February 19, 2026 — As the global race for mineral sovereignty reaches a fever pitch, the United States has intensified its multi-billion-dollar strategy to dismantle China’s long-standing monopoly over the rare earth supply chain. Central to this effort is a new wave of "friend-shoring" initiatives

Via MarketMinute · February 19, 2026

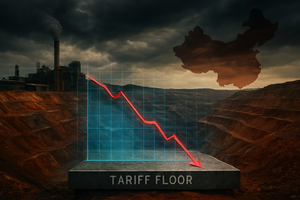

The U.S. is working on a critical minerals price-floor system to strengthen supply chains for resources considered vital to national security, according to a Bloomberg report.

Via Stocktwits · February 18, 2026

MP Materials and USA Rare Earth are solving the same problem. Which one will make investors rich over the long term?

Via The Motley Fool · February 14, 2026

President Trump's Project Vault has rare earth stocks surging. Here are 7 critical questions about which mining stocks could benefit from the $12B initiative.

Via InvestorPlace · February 13, 2026

The domestic critical minerals market has been set ablaze this February as shares of USA Rare Earth (NASDAQ: USAR) experienced a historic rally, surging more than 60% year-to-date. This explosive movement stems from a powerful confluence of massive federal intervention and high-level financial speculation. At the heart of the frenzy

Via MarketMinute · February 13, 2026

The U.S. government continues to support the domestic rare-earth industry, and that's good news for MP Materials.

Via The Motley Fool · February 13, 2026

NATO's action across the pond has investors uneasy about this rare earth stock today.

Via The Motley Fool · February 12, 2026

Securing a domestic supply of critical rare-earth materials and magnets is a priority for the current administration, which means USA Rare Earth is in favor.

Via The Motley Fool · February 12, 2026

As of February 11, 2026, the global economy is navigating the aftershocks of a geopolitical standoff that nearly dismantled the post-war trade order. The "Greenland Tariff Escalation," a high-stakes diplomatic confrontation sparked by the United States’ aggressive pursuit of the world’s largest island, has shifted from an imminent trade

Via MarketMinute · February 11, 2026

MP Materials surged 224% in 2025. Can the rare-earth miner beat the market in 2026?

Via The Motley Fool · February 11, 2026

Is this deal as good as it seems for USA Rare Earth?

Via The Motley Fool · February 10, 2026

Via MarketBeat · February 9, 2026

These mining stocks could help you hit pay dirt.

Via The Motley Fool · February 9, 2026

The periodic table never looked so lucrative. These three mining stocks want to capture the upside.

Via The Motley Fool · February 7, 2026

The geopolitical landscape was rocked in early 2026 by the so-called "Greenland Episode," a diplomatic and economic confrontation that has pushed the relationship between the United States and the European Union to its lowest point in decades. What began as a renewed U.S. strategic interest in the Arctic territory

Via MarketMinute · February 6, 2026

The rare earth stock could vault higher in 2026 if it meets this crucial target.

Via The Motley Fool · February 6, 2026

In a move that has sent shockwaves through global commodities markets, rare earth and critical materials stocks suffered a sharp sell-off this week following the U.S. administration's announcement of a "tariff floor" policy. The new regulatory framework, unveiled by Vice President J.D. Vance during a Critical Minerals Ministerial

Via MarketMinute · February 5, 2026