MasterCard (MA)

524.32

+3.32 (0.64%)

NYSE · Last Trade: Mar 3rd, 7:15 PM EST

Detailed Quote

| Previous Close | 521.00 |

|---|---|

| Open | 513.61 |

| Bid | 516.17 |

| Ask | 524.32 |

| Day's Range | 513.00 - 526.80 |

| 52 Week Range | 465.59 - 601.77 |

| Volume | 4,199,690 |

| Market Cap | 475.03B |

| PE Ratio (TTM) | 31.74 |

| EPS (TTM) | 16.5 |

| Dividend & Yield | 3.480 (0.66%) |

| 1 Month Average Volume | 4,140,252 |

Chart

About MasterCard (MA)

Mastercard is a global technology company that facilitates digital payments by connecting consumers, financial institutions, and merchants through its secure transaction processing networks. The company provides a range of payment solutions, including credit and debit card services, contactless payments, and mobile payment applications. Mastercard's platform aims to enhance the payment experience by offering innovative technologies and insights that help businesses and consumers make transactions easier, safer, and more efficient. Through partnerships with various stakeholders in the financial ecosystem, Mastercard continuously works to promote financial inclusion and empower people to transact in a digital world. Read More

News & Press Releases

On March 3, 2026, insider buying and a new stablecoin partnership could signal that investors are reassessing this digital-first bank.

Via The Motley Fool · March 3, 2026

The premiere financial services firm expects these two payment giants to get a big boost from AI. But both are reportedly facing a big threat.

Via Barchart.com · March 3, 2026

PROOFCORE . PUBG: Battlegrounds is a very popular game today. It’s an online multiplayer battle royale that many adventure players love. The gameplay is familiar to those who love playing this type of game.

Via Get News · March 3, 2026

SoFi shares moved after CEO Anthony Noto's $1 million buy and a new Mastercard partnership to use SoFiUSD for settlement, even as broader markets slid.

Via Benzinga · March 3, 2026

This ETF provides a simple way to invest in a basket of hundreds of financial stocks.

Via The Motley Fool · March 3, 2026

The scenario involves artificial intelligence (AI) succeeding.

Via The Motley Fool · March 3, 2026

Shares of PayPal Holdings, Inc. (NASDAQ: PYPL) surged by more than 10% in early trading on March 2, 2026, as the market reacted to a dual-threat of major corporate developments. The rally followed the official first day of Enrique Lores as the company’s new President and CEO, a transition

Via MarketMinute · March 2, 2026

Via MarketBeat · March 2, 2026

Level-up PUBG Games With PROOFCORE Undetectable Tricks

PROOFCORE. Every online player is familiar with “Player Unknown’s Battlegrounds. ” There is no question why PUBG is popular among gamers. This is a multiplayer battle royale game. The gameplay requires strategies to win. This game is loved by many. The gameplay is simple. Characters drop from a parachute onto the island. They will then […]

Via Worldnewswire · March 2, 2026

While strong cash flow is a key indicator of stability, it doesn’t always translate to superior returns.

Some cash-heavy businesses struggle with inefficient spending, slowing demand, or weak competitive positioning.

Via StockStory · March 1, 2026

WASHINGTON D.C. — In a historic shift that promises to redefine the landscape of global finance, the U.S. Congress has finalized a comprehensive legislative package to regulate the $200 billion stablecoin market. Following the foundational passage of the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act

Via MarketMinute · February 27, 2026

New York - SensePass today announced its recognition as the leading Dynamics 365 payment processing solution, powered by its global deployment with the largest customer in the Microsoft Dynamics 365 ecosystem. The enterprise retailer relies on SensePass to manage payment operations worldwide, reinforcing the platform’s position as the best choice for scalable, omnichannel Dynamics 365 payments.

Via AB Newswire · February 27, 2026

Via Benzinga · February 27, 2026

Reinvesting your payouts makes your portfolio grow even faster.

Via The Motley Fool · February 27, 2026

As of late February 2026, a massive wave of liquidity is washing over the American economy. Following the landmark passage of the One Big Beautiful Bill Act (OBBBA)—officially Public Law 119-21—in the summer of 2025, U.S. consumer bank accounts are now seeing the first major influx of

Via MarketMinute · February 26, 2026

By using fractional shares, you can build a Buffett-style starter portfolio.

Via The Motley Fool · February 26, 2026

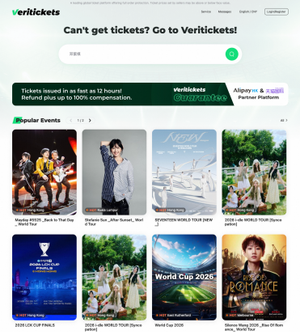

Veritickets offers a ticket issuance promise as fast as 12 hours and guarantees that every ticket is verified and valid for entry. The...

Via MediaOutReach · February 25, 2026

Over the last six months, Mastercard’s shares have sunk to $498.84, producing a disappointing 15.9% loss - a stark contrast to the S&P 500’s 6.2% gain. This might have investors contemplating their next move.

Via StockStory · February 24, 2026

AI disruption has hit Cloudflare, yet analysts remain broadly supportive. Will competitive concerns materially alter its long-term trajectory?

Via Barchart.com · February 24, 2026

While Bank of America has underperformed the SPX over the past year, Wall Street analysts maintain a strongly optimistic outlook on the stock’s prospects.

Via Barchart.com · February 24, 2026

As of February 24, 2026, American Express (NYSE: AXP) stands as a unique bellwether for the global economy. Long regarded as the gold standard for premium credit and travel services, the company finds itself at a critical crossroads. While the broader financial sector grapples with the fallout of heightened global trade tensions and a new [...]

Via Finterra · February 24, 2026

By TANAKA PRECIOUS METAL GROUP Co., Ltd. · Via JCN Newswire · February 24, 2026

While Visa has underperformed the S&P 500 Index over the past year, Wall Street analysts maintain a highly bullish outlook on its prospects.

Via Barchart.com · February 24, 2026

From stablecoins to machine-to-machine payments, a new report argues Visa, Mastercard and AmEx face a structural shakeup, not just another tech cycle.

Via Stocktwits · February 23, 2026