iShares 7-10 Year Treasury Bond ETF (IEF)

97.21

+0.25 (0.26%)

NASDAQ · Last Trade: Oct 14th, 9:27 PM EDT

Detailed Quote

| Previous Close | 96.96 |

|---|---|

| Open | 97.06 |

| Day's Range | 96.98 - 97.24 |

| 52 Week Range | 91.08 - 97.51 |

| Volume | 7,650,676 |

| Market Cap | - |

| Dividend & Yield | 3.768 (3.88%) |

| 1 Month Average Volume | 6,924,321 |

Chart

News & Press Releases

Jerome Powell Says Fed’s Tightening Program May Be Approaching The End In ‘Coming Months’stocktwits.com

Via Stocktwits · October 14, 2025

According to a Bloomberg report, Bowman added that the U.S. version of the Basel III norms is currently being negotiated with the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency.

Via Stocktwits · October 14, 2025

Via Benzinga · October 13, 2025

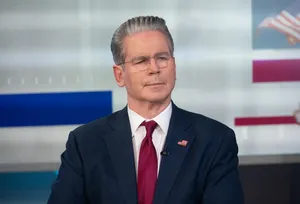

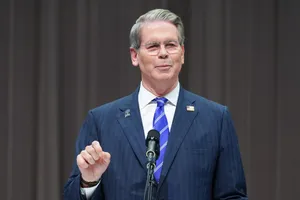

During an interview on Fox Business’ “Mornings with Maria” on Monday, Bessent said that there had been “substantial communication” over the weekend between the U.S. and China.

Via Stocktwits · October 13, 2025

Fed’s Waller Favors More Rate Cuts, But Warns Against Moving ‘Aggressively And Fast’: Reportstocktwits.com

Via Stocktwits · October 10, 2025

Scott Bessent Reportedly Blasts Dodd-Frank Rules, Says Its Purpose Was To End ‘Too Big To Fail’ But It Created ‘Too Small To Succeed’stocktwits.com

Via Stocktwits · October 9, 2025

Fed's Barr Says Trump-Era Big Bank Deregulation Leaves Community Banks Exposed To Falloutstocktwits.com

Via Stocktwits · October 8, 2025

Scott Bessent Reportedly Says Government Shutdown Could Hit US GDP: 'This Isn’t The Way To Have A Discussion'stocktwits.com

Via Stocktwits · October 2, 2025

According to a CNBC report, Bessent, along with two senior Treasury officials and two senior White House officials, will conduct another round of interviews with the five candidates over the coming weeks and months.

Via Stocktwits · October 10, 2025

The minutes also showed that labor market weakness remained among the top concerns of the central bank, which noted that though the unemployment rate remained low, the pace of employment increases had slowed.

Via Stocktwits · October 8, 2025

Miran said that the Federal Reserve’s current monetary policy is very restrictive for the U.S. economy.

Via Stocktwits · October 7, 2025

At the September FOMC meeting, when the central bank reduced the key rate by 25 basis points, Federal Reserve Governor Stephen Miran expressed dissent and voted for a larger 50-bps cut.

Via Stocktwits · October 3, 2025

Private Payrolls Decline 32,000 In September, Defy Wall Street Expectationsstocktwits.com

Via Stocktwits · October 1, 2025

New Home Sales Surge Over 20% In August, Beats Estimatesstocktwits.com

Via Stocktwits · September 24, 2025

Ed Yardeni Draws Parallels To Jerome Powell’s Equity Remarks With Alan Greenspan’s ‘Irrelational Exuberance’ Comments: Reportstocktwits.com

Via Stocktwits · September 24, 2025

Jerome Powell Sees ‘Challenging Situation’ Ahead, Says There Is No Risk-Free Pathstocktwits.com

Via Stocktwits · September 23, 2025

In an interview with CNBC, Goolsbee stated that he believes the U.S. economy can afford a “fair amount” of interest rate reduction from the current level, gradually over time.

Via Stocktwits · October 3, 2025

S&P 500 Hits Record High, Crosses 6,700 For First Time As Investors Bet On Rate Cut, Brush Aside Government Shutdownstocktwits.com

Via Stocktwits · October 1, 2025

The Boston Fed president stated that, with less scope for inflationary pressures from the labor market, the upside inflation risks are now more limited compared to a few months ago.

Via Stocktwits · September 30, 2025

In an interview with Fox Business, Bessent stated that he aims to complete the first round of interviews for Fed Chair candidates by the first week of October.

Via Stocktwits · September 24, 2025

If labor market conditions continue to deteriorate, Bowman expressed concern that interest rates would have to be adjusted at a faster pace and to a larger degree.

Via Stocktwits · September 23, 2025

Fed's Goolsbee Says He's 'Comfortable' With Interest Rate At 3% If Inflation Cools Down To 2%: Reportstocktwits.com

Via Stocktwits · September 23, 2025

Fed's Musalem Says There's 'Limited Room' For Further Rate Cuts Without Policy Becoming Overly Accommodativestocktwits.com

Via Stocktwits · September 22, 2025

According to a Reuters report, the Chicago Fed combined government and private data to provide policymakers with faster-moving updates to the unemployment data.

Via Stocktwits · September 23, 2025