Arm Holdings plc - American Depositary Shares (ARM)

121.72

+0.00 (0.00%)

NASDAQ · Last Trade: Mar 4th, 4:07 AM EST

Detailed Quote

| Previous Close | 121.72 |

|---|---|

| Open | - |

| Bid | 120.70 |

| Ask | 121.89 |

| Day's Range | N/A - N/A |

| 52 Week Range | 80.00 - 183.16 |

| Volume | 0 |

| Market Cap | - |

| PE Ratio (TTM) | 162.29 |

| EPS (TTM) | 0.8 |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 6,598,355 |

Chart

About Arm Holdings plc - American Depositary Shares (ARM)

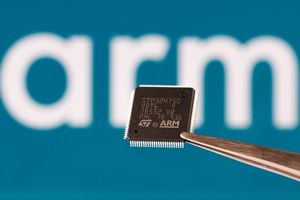

Arm Holdings plc is a leading technology company that specializes in semiconductor and software design, primarily focusing on microprocessor and system-on-chip (SoC) architectures. Its innovative designs are integral to a wide range of applications, from mobile devices to embedded systems and Internet of Things (IoT) products. Arm's technology enables low power consumption and efficient performance, making it a popular choice among manufacturers and developers in the electronics industry. The company collaborates closely with partners to drive the advancement of next-generation computing and connectivity solutions, playing a crucial role in shaping the future of digital devices and applications. Read More

News & Press Releases

Malaysia's anti-graft agency is investigating a $279 million deal between the government and Arm Holdings, as well as a potential IJM-Sunway acquisition, amid allegations of corruption and fraud.

Via Benzinga · March 4, 2026

The stock fell on margin concerns, but these may be overblown, offering investors an opportunity.

Via The Motley Fool · March 3, 2026

Should you go for memory stocks or good old Apple? This analyst thinks the latter is a buy.

Via Barchart.com · March 3, 2026

Sea stock sinks as investors punish the earnings miss in Q4. But there are ample reasons for long-term investors to load up on SE shares today.

Via Barchart.com · March 3, 2026

This underperforming AI stock is likely to get a nice shot in the arm after releasing its upcoming quarterly report.

Via The Motley Fool · March 3, 2026

SANTA CLARA, Calif. — As the first quarter of 2026 unfolds, the artificial intelligence sector finds itself at a paradoxical crossroads. NVIDIA Corp. (NASDAQ:NVDA) reported fourth-quarter fiscal 2026 earnings that shattered even the most bullish expectations, yet the market’s response has been one of calculated caution rather than unbridled

Via MarketMinute · March 3, 2026

As the opening bell rang on March 3, 2026, all eyes turned to Target Corporation (NYSE: TGT) as it released its fourth-quarter 2025 financial results. In a climate defined by a "K-shaped" economic recovery and a sudden spike in global energy prices, the Minneapolis-based retail giant delivered a "beat-and-raise" performance

Via MarketMinute · March 3, 2026

As of March 3, 2026, Best Buy Co., Inc. (NYSE: BBY) remains a fascinating case study in retail resilience. Once written off as a mere "showroom" for Amazon (NASDAQ: AMZN), the company has spent the last decade proving that brick-and-mortar expertise still holds immense value in an increasingly complex technological world. Today, Best Buy stands [...]

Via Finterra · March 3, 2026

Date: March 3, 2026 Introduction Target Corporation (NYSE: TGT) has long held a unique position in the American retail landscape, bridging the gap between the utilitarian bulk of big-box discounters and the aspirational curation of specialty boutiques. Often referred to by its affectionate nickname "Tar-zhay," the company has built a brand identity centered on "cheap-chic"—high-design [...]

Via Finterra · March 3, 2026

In the rapidly evolving landscape of enterprise technology, few companies have commanded as much intrigue, controversy, and market enthusiasm as Palantir Technologies Inc. (NYSE: PLTR). Once dismissed as a "black box" government contractor shrouded in secrecy, Palantir has reinvented itself as the foundational operating system for the modern AI-driven enterprise. As of today, March 3, [...]

Via Finterra · March 3, 2026

Although investors buy Nvidia to gain exposure to its world-leading graphics processing units (GPUs), the company also oversees a $13.1 billion investment portfolio.

Via The Motley Fool · March 3, 2026

March 3, 2026 -- A charity event with many reasons to smile!

Via 24-7 Press Release · March 3, 2026

In a dramatic shift for financial markets on March 2, 2026, shares of Goldman Sachs (NYSE:GS) collapsed below a critical technical support level of $868.44, officially completing a bearish "Head and Shoulders" topping pattern that has been months in the making. This technical breakdown occurred against a backdrop

Via MarketMinute · March 2, 2026

BTCPressWire was founded by PR veterans, so we understand your pain points and know how to address them.

Via GlobePRwire · March 2, 2026

The final week of February 2026 has sent shockwaves through the alternative asset management industry, as the sector’s two largest titans, Apollo Global Management Inc. (NYSE: APO) and KKR & Co. Inc. (NYSE: KKR), experienced a brutal sell-off. What began as a localized concern over private credit redemptions quickly spiraled

Via MarketMinute · March 2, 2026

Shares of PayPal Holdings, Inc. (NASDAQ: PYPL) surged by more than 10% in early trading on March 2, 2026, as the market reacted to a dual-threat of major corporate developments. The rally followed the official first day of Enrique Lores as the company’s new President and CEO, a transition

Via MarketMinute · March 2, 2026

As of March 2, 2026, the era of Urban Air Mobility (UAM) is no longer a futuristic concept found in science fiction—it is a tangible reality taxiing onto the world’s runways. At the center of this transportation revolution is Archer Aviation (NYSE: ACHR), a company that has spent the last half-decade navigating the grueling gauntlet [...]

Via Finterra · March 2, 2026

As of March 2, 2026, NVIDIA Corporation (NASDAQ: NVDA) stands not merely as a semiconductor company, but as the foundational utility of the global intelligence economy. While the initial "AI gold rush" of 2023 and 2024 focused on the frantic acquisition of compute power to train Large Language Models (LLMs), 2026 has ushered in the [...]

Via Finterra · March 2, 2026

As of March 2, 2026, Palantir Technologies (NYSE: PLTR) has evolved from a secretive Silicon Valley data firm into the definitive "AI Operating System" for the Western world. Once viewed with skepticism by Wall Street due to its heavy reliance on government defense contracts and a complex "black box" business model, the company has spent [...]

Via Finterra · March 2, 2026

Claude Cowork announced new integrations for each of these software companies.

Via Barchart.com · March 2, 2026

MissionIRNewsBreaks – Beeline Holdings Inc. (NASDAQ: BLNE) Featured by Streetwise Reports for Rapid Revenue Growth and Fintech Expansion

Beeline (NASDAQ: BLNE), a rapidly growing fintech company, was highlighted by Streetwise Reports in a Feb. 27, 2026 article examining the Company’s accelerating revenue trajectory and market positioning within the U.S. mortgage sector. According to Streetwise Reports, Beeline owns 100% of an independent mortgage banker, a title company and a B2B SaaS products company, along with a minority stake in an AI sales tools firm. Its flagship AI-enabled, digital end-to-end financing platform delivers debt and equity solutions to homeowners and property investors more seamlessly and cost-effectively. With more than $1 billion in cumulative loan originations, Beeline is targeting the expansive U.S. mortgage market through AI-driven lead generation and conversion. Its product suite includes Beeline Loans for fully digital mortgage originations, Beeline Title for streamlined in-house title services, a B2B SaaS audit tool designed to meet lender compliance requirements and Beeline Equity, a fractional equity product positioned as an alternative to HELOCs and other traditional financing solutions.

Via Investor Brand Network · March 2, 2026

AES, a renewable energy company, will be purchased by BlackRock and other coinvestors. On Monday, shares dropped over 15% before the open.

Via Investor's Business Daily · March 2, 2026

Cumming, GA - March 02, 2026 - Precision Welding Group has announced expanded visibility and availability of mobile welding fume extraction solutions through its product catalog, featuring FilToo Mobile configurations (including FilToo Mobile with work surface) and CareMaster Mobile units designed for adaptable, point-of-use fume control in fabrication environments.

Via AB Newswire · March 2, 2026

Regarded as defensive investments, consumer staples stocks are generally safe bets in choppy markets. The flip side is that they frequently fall behind growth industries when times are good,

and this was the reality over the past six months as the sector’s flat performance trailed the S&P 500’s 7.7% gain.

Via StockStory · March 1, 2026