Articles from Milliman, Inc.

Milliman, Inc., a premier global consulting and actuarial firm, today released its monthly Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

By Milliman, Inc. · Via Business Wire · June 6, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today announced the results of its 2025 Registered Index-Linked Annuity (RILA) Industry Experience Study.

By Milliman, Inc. · Via Business Wire · June 5, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today released the latest results of its Public Pension Funding Index (PPFI), which analyzes data from the nation’s 100 largest public defined benefit plans.

By Milliman, Inc. · Via Business Wire · May 30, 2025

Milliman, Inc., the premier global consulting and actuarial firm, today announced the release of the 2025 Milliman Medical Index (MMI), which measures healthcare costs for Americans covered by a typical employer-sponsored health insurance plan. Healthcare costs for the average person increased 6.7% in 2025, with pharmacy costs increasing by 9.7% and outpatient facility care costs rising 8.5%. Healthcare costs for a hypothetical family of four rose to $35,119.

By Milliman, Inc. · Via Business Wire · May 27, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today released its monthly Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

By Milliman, Inc. · Via Business Wire · May 12, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its 2025 Corporate Pension Funding Study (PFS), which analyzes data for the 100 U.S. public companies with the largest defined benefit (DB) pension plans, as of their 2024 fiscal years (FY). This marks the 25th consecutive year in which the report has been published.

By Milliman, Inc. · Via Business Wire · May 1, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today released the latest results of its Public Pension Funding Index (PPFI), which analyzes data from the nation’s 100 largest public defined benefit plans.

By Milliman, Inc. · Via Business Wire · April 18, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today announced the fourth quarter (Q4) 2024 results of the Milliman Mortgage Default Index (MMDI), which shows a slight decrease in the lifetime serious delinquency rate (for homes 180 days or more delinquent) for U.S.-backed mortgages. The Q4 2024 MMDI dipped to 2.12%, compared to a restated 2.18% in Q3.

By Milliman, Inc. · Via Business Wire · April 16, 2025

Milliman, Inc., a premier actuarial, consulting, and benefits administration firm, is pleased to announce multiple recognitions by PLANSPONSOR as part of their annual awards for excellence.

By Milliman, Inc. · Via Business Wire · April 14, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today released its monthly Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

By Milliman, Inc. · Via Business Wire · April 9, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI). During February, the estimated cost to transfer retiree pension risk to an insurer in a competitive bidding process ticked up from 101.6% to 101.7% of a plan’s accounting liabilities (accumulated benefit obligation, or ABO). That means the estimated retiree PRT cost is now 101.7% of a plan’s ABO.

By Milliman, Inc. · Via Business Wire · March 25, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today released the latest results of its Public Pension Funding Index (PPFI), which analyzes data from the nation’s 100 largest public defined benefit plans.

By Milliman, Inc. · Via Business Wire · March 20, 2025

Milliman, Inc., a premier global consulting, actuarial, and benefits administration firm, announced that it’s celebrating the 30th anniversary of the Co-op 401(k) Plan by offering a 30% discount for new cooperatives who join the Plan in 2025.

By Milliman, Inc. · Via Business Wire · March 13, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today released its monthly Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

By Milliman, Inc. · Via Business Wire · March 7, 2025

Milliman, Inc., a premier global consulting and actuarial firm, is pleased to announce its Milliman Mind software has won two InsuranceERM – UK & Europe awards for 2025: Analytics Solution of the Year and Actuarial Modelling Solution of the Year.

By Milliman, Inc. · Via Business Wire · March 6, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today released the latest results of its Public Pension Funding Index (PPFI), which analyzes data from the nation’s 100 largest public defined benefit plans.

By Milliman, Inc. · Via Business Wire · February 27, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI). During January, the estimated cost to transfer retiree pension risk to an insurer in a competitive bidding process increased from 101.4% to 101.6% of a plan’s accounting liabilities (accumulated benefit obligation, or ABO). That means the estimated retiree PRT cost is now 101.6% of a plan’s ABO.

By Milliman, Inc. · Via Business Wire · February 24, 2025

Milliman, Inc., a premier global actuarial consulting, risk management, and technology firm, today released its 2025 report on U.S. organ and tissue transplant costs and utilization. This comprehensive study provides valuable insight into the financial landscape and emerging trends in transplant care, including estimated transplants, lengths of hospital stay, and average annual costs per member per month (PMPM) across single organ/tissue and double-organ/tissue transplants.

By Milliman, Inc. · Via Business Wire · February 13, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of the latest monthly Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

By Milliman, Inc. · Via Business Wire · February 10, 2025

Milliman, Inc., the premier global consulting and actuarial firm, today announced the election of Bret Linton as its next Chair of the Board. Linton joined Milliman in 2009 and has most recently served as Global Practice Director, Employee Benefits. Linton will succeed Ken Mungan, who is completing a 10-year, term-limited tenure as Chair.

By Milliman, Inc. · Via Business Wire · January 29, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI). During December, the estimated cost to transfer retiree pension risk to an insurer in a competitive bidding process increased from 101.2% to 101.4% of a plan’s accounting liabilities (accumulated benefit obligation, or ABO). That means the estimated retiree PRT cost is now 101.4% of a plan’s ABO. During the same time period, the average annuity purchase cost across all insurers in our index also increased, from 103.9% to 104.0%. The competitive bidding process is estimated to save plan sponsors about 2.6% of PRT costs as of December 31.

By Milliman, Inc. · Via Business Wire · January 22, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today released the latest results of its annual Public Pension Funding Study (PPFS), which reviews the funded status of the nation’s 100 largest public defined benefit pension plans.

By Milliman, Inc. · Via Business Wire · January 13, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today released the 2024 year-end results of its Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

By Milliman, Inc. · Via Business Wire · January 8, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today announced the third quarter (Q3) 2024 results of the Milliman Mortgage Default Index (MMDI), which shows Milliman’s latest monthly estimate of the lifetime serious delinquency rates (180 days +) of U.S.-backed mortgages.

By Milliman, Inc. · Via Business Wire · January 7, 2025

Milliman, Inc., a premier global consulting and actuarial firm, today announced the results of its two 2024 Fixed Indexed Annuity Industry Experience Studies. These comprehensive studies analyze policyholder behavior, including factors such as the contract holder’s age at issue, length and magnitude of the contract, methods of distribution, and tax implications. The two studies cover surrender behavior and partial withdrawals, including income utilization for guaranteed lifetime withdrawal benefit (GLWB) riders.

By Milliman, Inc. · Via Business Wire · January 3, 2025

Milliman, Inc., a premier global consulting and actuarial firm, is pleased to announce the 2024 recipients of its Opportunity Scholarship program.

By Milliman, Inc. · Via Business Wire · December 19, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI). As the pension risk transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer.

By Milliman, Inc. · Via Business Wire · December 19, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

By Milliman, Inc. · Via Business Wire · December 9, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI). As the pension risk transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer.

By Milliman, Inc. · Via Business Wire · November 21, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the latest results of its Public Pension Funding Index (PPFI), which analyzes data from the nation’s 100 largest public defined benefit plans.

By Milliman, Inc. · Via Business Wire · November 20, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

By Milliman, Inc. · Via Business Wire · November 7, 2024

Milliman, Inc., a premier global actuarial, consulting, and risk management firm, today announced that the firm has won “Climate and sustainability consultancy of the year” in the 2024 InsuranceERM Climate Risk & Sustainability awards.

By Milliman, Inc. · Via Business Wire · October 31, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI). As the pension risk transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer.

By Milliman, Inc. · Via Business Wire · October 22, 2024

Milliman, Inc., the premier global consulting and actuarial firm, is providing auto insurers with access to CARFAX Vehicle Risk Scores as part of its Appleseed product. Milliman Appleseed® will pre-file these risk scores with state insurance regulators thereby reducing regulatory risk and enabling insurers to adopt them more easily.

By Milliman, Inc. · Via Business Wire · October 17, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the latest results of its Public Pension Funding Index (PPFI), which analyzes data from the nation’s 100 largest public defined benefit plans.

By Milliman, Inc. · Via Business Wire · October 15, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

By Milliman, Inc. · Via Business Wire · October 7, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today announced an upcoming transition in leadership. Milliman Chair of the Board Ken Mungan is retiring in early 2025 following a full 10-year, term-limited tenure leading the consulting and technology firm. Mungan’s time as chair is notable for strong growth, expansion into new markets, and a visible commitment to mission-driven work.

By Milliman, Inc. · Via Business Wire · September 25, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Public Pension Funding Index (PPFI), which analyzes data from the nation’s 100 largest public defined benefit plans.

By Milliman, Inc. · Via Business Wire · September 20, 2024

Milliman, Inc., a premier global consulting and actuarial firm, announced today that the Milliman Giving Fund awarded a grant to Partners in Health (PIH) and their nonprofit partner Community Outreach and Patient Empowerment (COPE), who works across Navajo Nation.

By Milliman, Inc. · Via Business Wire · September 17, 2024

Milliman, Inc., a premier global consulting and actuarial firm, announced today that the Milliman Giving Fund has awarded a grant to Splash International. The $750,000 grant is for a three-year period to fund Splash’s Project WISE (Wash in Schools for Everyone).

By Milliman, Inc. · Via Business Wire · September 17, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

By Milliman, Inc. · Via Business Wire · September 10, 2024

Milliman, Inc., a global consulting, actuarial, and benefits administration firm, today announced the introduction of a student loan certification solution for its 401(k) recordkeeping clients through Candidly.

By Milliman, Inc. · Via Business Wire · September 10, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today announced the second quarter (Q2) 2024 results of the Milliman Mortgage Default Index (MMDI), which shows Milliman’s latest monthly estimate of the lifetime serious delinquency rates (180 days +) of U.S.-backed mortgages.

By Milliman, Inc. · Via Business Wire · September 3, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI). As the pension risk transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer.

By Milliman, Inc. · Via Business Wire · August 20, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the midyear 2024 results of its Multiemployer Pension Funding Study (MPFS), which analyzes the funded status of all multiemployer defined benefit (DB) pension plans in the United States. As of June 30, 2024, the aggregate funded percentage for U.S. multiemployer plans has reached 93%, up from 89% at the end of 2023, marking the highest funding level since 2007.

By Milliman, Inc. · Via Business Wire · August 15, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Public Pension Funding Index (PPFI), which analyzes data from the nation’s 100 largest public defined benefit plans.

By Milliman, Inc. · Via Business Wire · August 14, 2024

Milliman, Inc., a premier global consulting and actuarial firm, is proud to announce the launch of Milliman Connect, a groundbreaking solution designed to seamlessly integrate disparate data and systems across insurers. This innovative platform empowers insurance carriers, voluntary benefit providers, MGAs, TPAs, and brokers, helping them unify their data, streamline operations, and drive informed decision-making.

By Milliman, Inc. · Via Business Wire · August 12, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

By Milliman, Inc. · Via Business Wire · August 5, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today announced the acquisition of Pluritem Health, the next generation clinical data platform. Pluritem Health aggregates and analyzes patients’ medical histories to improve quality and cost effectiveness of patient care across the healthcare industry, including direct primary care physicians, onsite/near-site clinics, telehealth, care management teams, and hospital settings.

By Milliman, Inc. · Via Business Wire · August 1, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today announced that the firm, in conjunction with the California Fire Chiefs Foundation (CFCF), was awarded a Moore Foundation grant to support the development of a Wildland-Urban Interface (WUI) Data Commons. This pioneering initiative is aimed at enhancing wildfire risk management and mitigation efforts across the West.

By Milliman, Inc. · Via Business Wire · July 31, 2024

Milliman, Inc., a premier global consulting and actuarial firm, has released a groundbreaking estimate of the economic liability associated with the remediation of perfluoroalkyl and polyfluoroalkyl substances (PFAS) in U.S. water districts. Using a proprietary stochastic modeling approach, Milliman projects that the total expected cost for remediating drinking water systems contaminated with PFAS will range between $120 billion and $175 billion.

By Milliman, Inc. · Via Business Wire · July 29, 2024

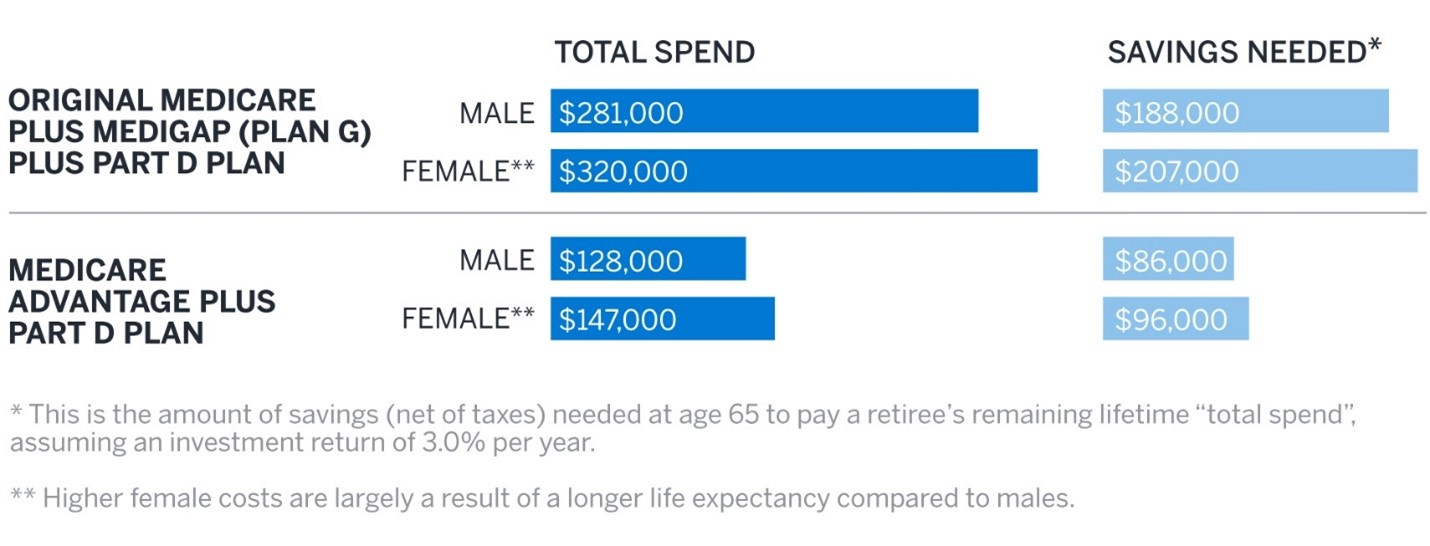

Milliman, Inc., a premier global consulting and actuarial firm, recently released its 2024 Retiree Health Cost Index which projects how much money, on average, a healthy 65-year-old can expect to spend on healthcare costs in retirement. The index explains how factors like when a person retires, where a person lives, and which coverage a person chooses will impact the total cost of premiums and out-of-pocket expenses.

By Milliman, Inc. · Via Business Wire · July 24, 2024

Milliman, Inc., a leading global consulting, actuarial, and benefits administration firm, announced today the introduction of a guaranteed lifetime income option for its 401(k) recordkeeping clients through Hueler Income Solutions® Think IncomeSM.

By Milliman, Inc. · Via Business Wire · July 23, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI). As the pension risk transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer.

By Milliman, Inc. · Via Business Wire · July 19, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Public Pension Funding Index (PPFI), which analyzes data from the nation’s 100 largest public defined benefit plans.

By Milliman, Inc. · Via Business Wire · July 17, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

By Milliman, Inc. · Via Business Wire · July 9, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI). As the pension risk transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer.

By Milliman, Inc. · Via Business Wire · June 18, 2024

Milliman, Inc., one of the premier global consulting, actuarial, and benefits administration firms, announced today that it has launched an enhanced financial wellness experience for participants in Milliman-administered retirement plans.

By Milliman, Inc. · Via Business Wire · June 18, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the latest results of its Public Pension Funding Index (PPFI), which analyzes data from the nation’s 100 largest public defined benefit plans.

By Milliman, Inc. · Via Business Wire · June 17, 2024

Milliman, Inc., a leading global consulting and actuarial firm, is delighted to announce that it has taken top honors in two categories in the InsuranceERM Americas Awards 2024 for its comprehensive cloud-based actuarial modeling and reporting solution, Milliman Integrate®.

By Milliman, Inc. · Via Business Wire · June 17, 2024

Milliman, Inc., one of the premier global consulting, actuarial, and benefits administration firms, announced today that it has won a 2024 Gold Quill Award in Digital Communication from the International Association of Business Communicators (IABC). Milliman received a Gold Quill Award of Merit for the “Parkland Health Benefit Information Website,” developed for client Parkland Health.

By Milliman, Inc. · Via Business Wire · June 11, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

By Milliman, Inc. · Via Business Wire · June 10, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI). As the pension risk transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer.

By Milliman, Inc. · Via Business Wire · May 22, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today announced the release of the 2024 Milliman Medical Index (MMI), which measures healthcare costs for Americans covered by a typical employer-sponsored health insurance plan. Healthcare costs for the average person increased 6.7% in 2024, with pharmacy costs increasing by 13% and constituting nearly half of this year’s total increase. Healthcare costs for a hypothetical family of four rose to $32,066.

By Milliman, Inc. · Via Business Wire · May 21, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the latest results of its Public Pension Funding Index (PPFI), which analyzes data from the nation’s 100 largest public defined benefit plans.

By Milliman, Inc. · Via Business Wire · May 17, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

By Milliman, Inc. · Via Business Wire · May 13, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI). As the pension risk transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer.

By Milliman, Inc. · Via Business Wire · April 26, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its 2024 Corporate Pension Funding Study (PFS), which analyzes data for the 100 U.S. public companies with the largest defined benefit (DB) pension plans, as of their 2023 fiscal years (FY). The plans in this study represent employers across multiple business sectors, including communications, healthcare, financial services, and others. This marks the 24th consecutive year in which the report has been published.

By Milliman, Inc. · Via Business Wire · April 24, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the latest results of its Public Pension Funding Index (PPFI), which analyzes data from the nation’s 100 largest public defined benefit plans.

By Milliman, Inc. · Via Business Wire · April 19, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

By Milliman, Inc. · Via Business Wire · April 4, 2024

Milliman, Inc., one of the premier actuarial, consulting, and benefits administration firms, is pleased to announce that it has been recognized by PLANSPONSOR as a 2024 Best in Class defined contribution (DC) recordkeeper.

By Milliman, Inc. · Via Business Wire · April 1, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today released the latest results of its Public Pension Funding Index (PPFI), which analyzes data from the nation’s 100 largest public defined benefit plans.

By Milliman, Inc. · Via Business Wire · March 22, 2024

Milliman, Inc., a premier global consulting and actuarial firm, is pleased to announce the 2023 recipients of its Opportunity Scholarship program.

By Milliman, Inc. · Via Business Wire · March 21, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI). As the pension risk transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer.

By Milliman, Inc. · Via Business Wire · March 15, 2024

Milliman, Inc., a premier global consulting and actuarial firm, today announced the fourth quarter (Q4) 2023 results of the Milliman Mortgage Default Index (MMDI), which shows Milliman’s latest monthly estimate of the lifetime serious delinquency rates (180 days +) of U.S.-backed mortgages.

By Milliman, Inc. · Via Business Wire · March 13, 2024