Articles from Korea Zinc Company, ltd

According to local media reports *, Young Poong Group, currently engaged in a management dispute with Korea Zinc (KRX:010130), will no longer be able to export sulfuric acid, a hazardous yet essential byproduct from its zinc smelting processes at the Seokpo Smelter, via Korea Zinc’s Onsan Smelter as of January 11. Already hit by a suspension of operations, Young Poong now faces the additional challenge of potentially reducing production further, compounding its difficulties.

By Korea Zinc Company, ltd · Via Business Wire · January 14, 2025

Korea Zinc (KRX:010130) has raised concerns about the tactics employed by MBK Partners and Young Poong in their ongoing hostile takeover attempt. Questions are mounting over the intent and timing of their repeated injunction filings, which coincide with critical events, including a 58-day suspension of Young Poong’s smelting operations due to environmental violations. These actions are drawing criticism for allegedly misleading the market and undermining the rights of minority shareholders.

By Korea Zinc Company, ltd · Via Business Wire · December 31, 2024

Rep. Eric Swalwell, Co-Chair of the Congressional Critical Materials Caucus, has sent an official letter to Jose Fernandez, Undersecretary of State for Economic Growth, Energy, and the Environment, expressing concerns about the takeover battle over Korea Zinc (KRX:010130) and urging active involvement from the U.S. Department of State.

By Korea Zinc Company, ltd · Via Business Wire · December 26, 2024

After the board of Korea Zinc (KRX:010130) proposed various resolutions that give priority to shareholder values and protections for the rights of shareholders to discuss at next month’s extraordinary general meeting (EGM), MBK Partners and Young Poong have intensified vicious slanders on the board’s resolutions. Such a move rather proves the significance of these resolutions proposed by the board to the extent that they could disrupt the consortium’s attempt to take control of the board at the upcoming session, the only purpose of the consortium throughout its takeover bid. The consortium’s frustration at the resolutions is clearly shown in its contradictory stance on the adoption of cumulative voting, an iconic means of protecting minority shareholders and board diversity.

By Korea Zinc Company, ltd · Via Business Wire · December 25, 2024

The Korea Zinc (KRX:010130) labor union recently convened a meeting with the Federation of Korean Metalworkers' Trade Unions (FKMTU), a member of the Federation of Korean Trade Unions (FKTU), to request solidarity and support as the union expands its fight against the MBK Partners’ hostile takeover attempt.

By Korea Zinc Company, ltd · Via Business Wire · December 20, 2024

Korea Zinc (KRX:010130) filed a complaint with the Financial Supervisory Service (FSS) on December 15, calling for an investigation into potential violation of a non-disclosure agreement (NDA) and the use of non-public information by MBK Partners. Korea Zinc suspects that MBK used confidential information shared under NDA in the past – a 112-page document outlining the company’s Troika Drive strategy and a forecast of Korea Zinc’s valuation – in launching the hostile M&A, seriously destabilizing the market and causing trading disruptions. Korea Zinc argues that a comprehensive inspection of MBK’s potential breach of the Financial Investment Services and Capital Markets Act (FSCMA) is necessary.

By Korea Zinc Company, ltd · Via Business Wire · December 16, 2024

According to a media report, MBK Partners, currently pursuing a hostile takeover of Korea Zinc (KRX:010130), is facing criticism over an alleged "overpayment" following additional share purchases, leading to growing discontent among some investors.

By Korea Zinc Company, ltd · Via Business Wire · December 16, 2024

Korea Zinc (KRX:010130) has released a statement today to debunk false allegations and misleading claims presented by MBK Partners during the press conference held on December 10.

By Korea Zinc Company, ltd · Via Business Wire · December 15, 2024

A recent report by a local media outlet and online broadcast has brought to light serious allegations that MBK Partners may have misused confidential business data obtained from Korea Zinc (KRX:010130) during a prior investment evaluation process. The claims suggest that MBK may have leveraged sensitive information shared under a Non-Disclosure Agreement (NDA) to orchestrate its current hostile takeover attempt in collaboration with Young Poong. These accusations raise significant concerns about ethical practices in the private equity sector and the integrity of MBK’s acquisition strategy.

By Korea Zinc Company, ltd · Via Business Wire · December 2, 2024

Korea Zinc (KRX:010130) announced that it has applied for its smelting technologies to be designated as a national core technology. This follows the recent announcement by the Korean government to designate Korea Zinc’s high-nickel precursor manufacturing technology both as a national core technology and national high-tech strategic technology. Companies with such designations require government approval in case of an acquisition by a foreign company, safeguarding them for economic and security reasons. This move is interpreted as a strategic step to prevent the potential sale of Korea Zinc to the alliance between MBK Partners and Young Poong.

By Korea Zinc Company, ltd · Via Business Wire · November 22, 2024

Australian lawmakers have expressed concerns over the ongoing ownership battle for Korea Zinc (KRX:010130), the world’s largest zinc smelter. The high-profile dispute, which pits Korea Zinc's Chairman Yun B. Choi against an alliance led by MBK Partners and Young Poong, has raised fears of potential disruptions from foreign entities in clean energy projects and the global zinc supply chain. The South Korean government has also acted by designating Korea Zinc’s proprietary technology as a “National Core Technology.”

By Korea Zinc Company, ltd · Via Business Wire · November 20, 2024

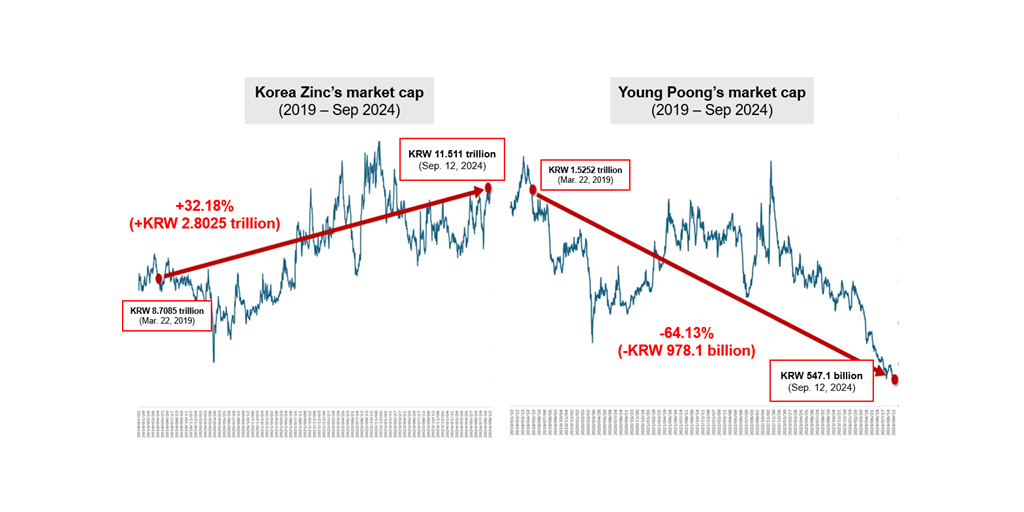

Amid the ongoing governance dispute over Korea Zinc (KRX:010130), there is growing public interests around the track records of the involved parties, particularly MBK Partners. MBK’s past investment activities in Korea have come under scrutiny, raising questions about the potential impact on Korea Zinc’s future.

By Korea Zinc Company, ltd · Via Business Wire · November 19, 2024

Korea Zinc (KRX:010130), the world’s leading non-ferrous metal smelting company, reported on Nov. 12 its consolidated Q3 revenue of KRW 3.2 trillion, marking a substantial 40% year-on-year increase. Amid challenging conditions, including fluctuating exchange rates and elevated maintenance costs, Korea Zinc’s solid performance highlights its strategic resilience and sustained growth.

By Korea Zinc Company, ltd · Via Business Wire · November 15, 2024

At today’s press conference, Yun B. Choi, Chairman of Korea Zinc (KRX:010130), the world’s leading non-ferrous metal smelting company, announced strategic initiatives to enhance the company’s corporate governance, transparency and shareholder engagement. He committed to fortifying board independence, enhancing corporate governance and increasing protection and engagement for minority shareholders, making Korea Zinc a company that listens more closely to its stakeholders. As part of these measures, Korea Zinc will advance plans to have an independent director serve as Chair of the Board.

By Korea Zinc Company, ltd · Via Business Wire · November 13, 2024

Korea Zinc (KRX:010130), a global leader in the production of non-ferrous metals and a key player in critical supply chains, today issued an official statement following the end of MBK-Young Poong’s tender offer for Korea Zinc’s shares. MBK-Young Poong revealed through a regulatory filing that they have secured a 5.34% stake, falling short of their minimum target of 7%.

By Korea Zinc Company, ltd · Via Business Wire · October 15, 2024

Vice Chairman Lee Je-joong, a living witness to Korea Zinc's history of growth, held a press conference on Sep. 24, stating, “I, along with key technical personnel and all employees of Korea Zinc (KRX:010130), stand united with the current management.” He emphasized, “If speculative funds like MBK Partners were to take control of Korea Zinc, key technologies will be siphoned off in no time, undermining the competitiveness of Korea.” Lee also made it clear that the responsibility for the current situation falls on the Young Poong advisor Jang Hyung-jin.

By KOREA ZINC COMPANY, LTD · Via Business Wire · September 25, 2024

Pedalpoint Holdings, a U.S. subsidiary of nonferrous metal smelting company Korea Zinc (KRX:010130), announced its acquisition of Kataman Metals, a global scrap metal trading company based in St. Louis, USA. This acquisition will be a stepping stone to further strengthen Korea Zinc’s value chain in the resource recycling business, one of the pillars of the company’s new growth engine, dubbed "Troika Drive.”

By KOREA ZINC COMPANY, LTD · Via Business Wire · April 4, 2024

Korea Zinc (KRX:010130), the world's leading non-ferrous smelting company, successfully hosted its first investor relations event, the "2023 Investor Day," and presented its future vision and growth strategy for the next ten years to stakeholders.

By Korea Zinc Company, ltd · Via Business Wire · December 7, 2023