While the broader market has struggled with the S&P 500 down 2.1% since November 2024, Coursera has surged ahead as its stock price has climbed by 19% to $8.46 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Coursera, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Coursera Not Exciting?

We’re happy investors have made money, but we're cautious about Coursera. Here are three reasons why there are better opportunities than COUR and a stock we'd rather own.

1. Customer Spending Decreases, Engagement Falling?

Average revenue per customer (ARPC) is a critical metric to track because it measures how much the average customer spends. ARPC is also a key indicator of how valuable its customers are (and can be over time).

Coursera’s ARPC fell over the last two years, averaging 5.2% annual declines. This isn’t great, but the increase in paying users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Coursera tries boosting ARPC by taking a more aggressive approach to monetization, it’s unclear whether customers can continue growing at the current pace.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Coursera’s revenue to rise by 4.1%, a deceleration versus its 16.4% annualized growth for the past three years. This projection is underwhelming and indicates its products and services will face some demand challenges.

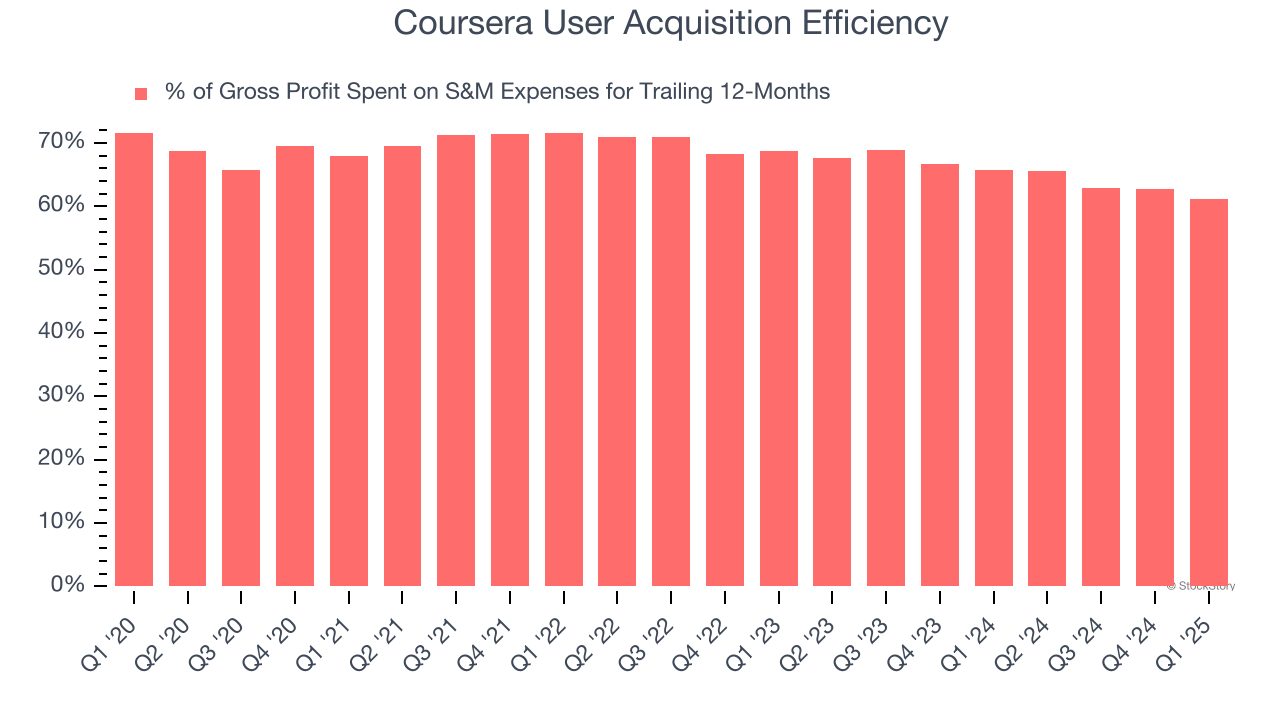

3. Poor Marketing Efficiency Drains Profits

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Coursera grow from a combination of product virality, paid advertisement, and incentives.

It’s very expensive for Coursera to acquire new users as the company has spent 61.1% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates a highly competitive environment with little differentiation between Coursera and its peers.

Final Judgment

Coursera isn’t a terrible business, but it doesn’t pass our bar. With its shares topping the market in recent months, the stock trades at 24.3× forward EV/EBITDA (or $8.46 per share). At this valuation, there’s a lot of good news priced in - we think there are better investment opportunities out there. We’d recommend looking at a top digital advertising platform riding the creator economy.

Stocks We Like More Than Coursera

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.