Foot Locker currently trades at $24.01 per share and has shown little upside over the past six months, posting a middling return of 3.8%. However, the stock is beating the S&P 500’s 2.1% decline during that period.

Is there a buying opportunity in Foot Locker, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Foot Locker Will Underperform?

Despite the relative momentum, we're swiping left on Foot Locker for now. Here are three reasons why we avoid FL and a stock we'd rather own.

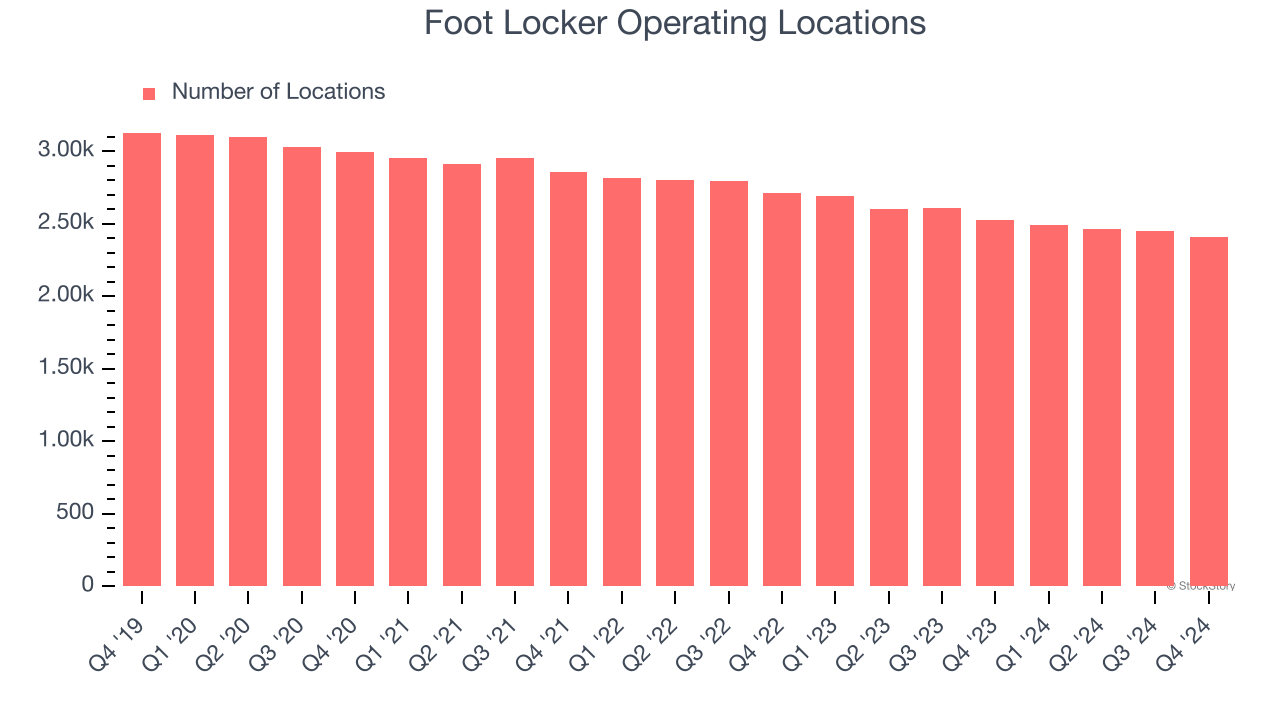

1. Stores Are Closing, a Headwind for Revenue

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Foot Locker listed 2,410 locations in the latest quarter and has generally closed its stores over the last two years, averaging 6.1% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

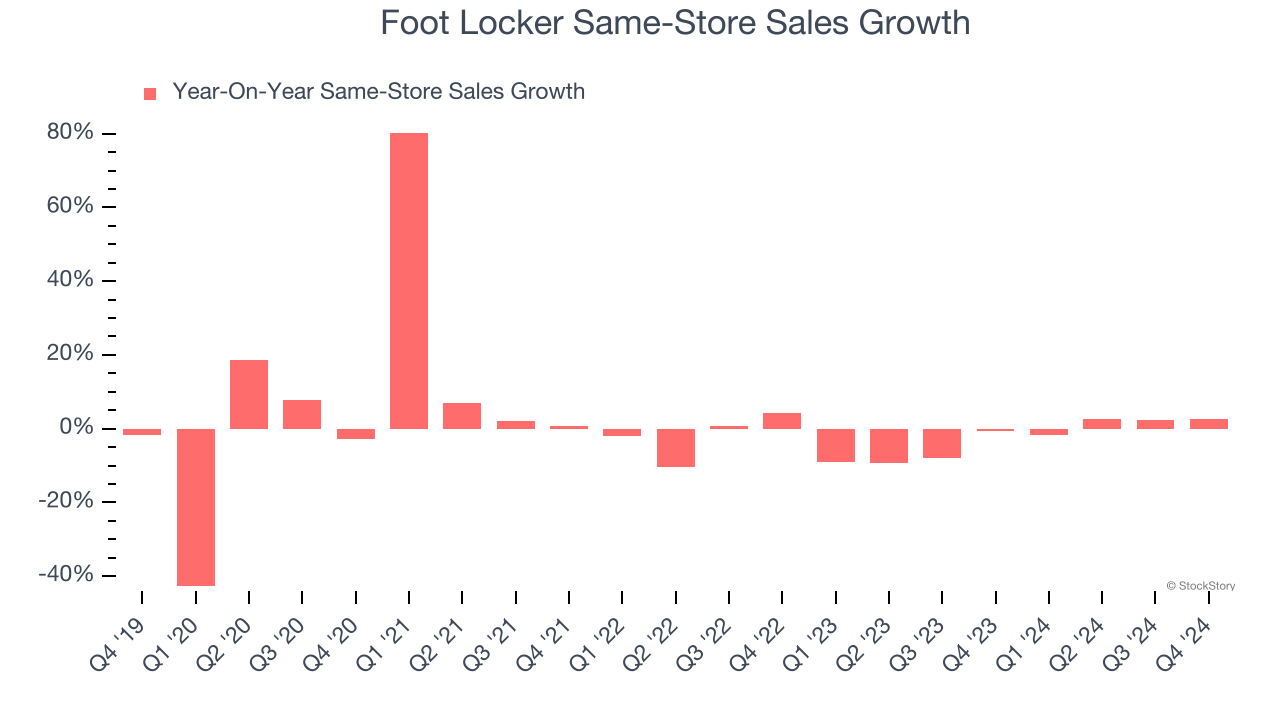

2. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Foot Locker’s demand has been shrinking over the last two years as its same-store sales have averaged 2.7% annual declines.

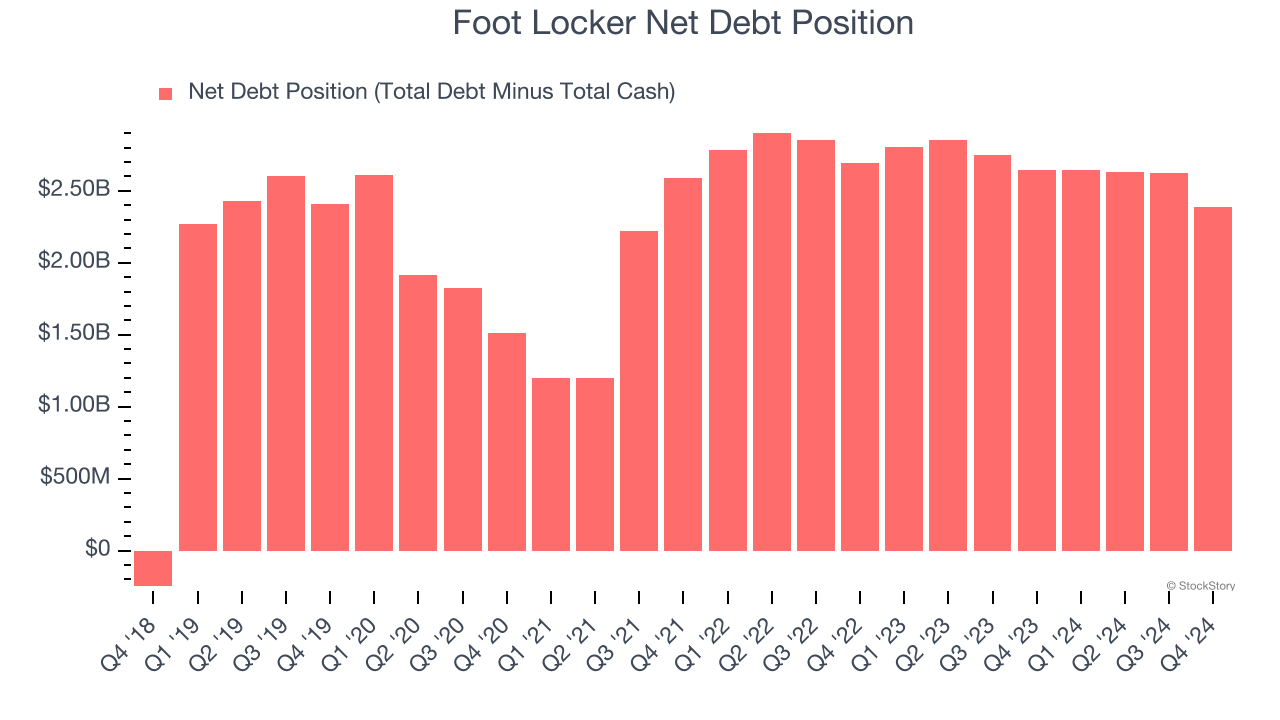

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Foot Locker’s $2.79 billion of debt exceeds the $401 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $402 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Foot Locker could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Foot Locker can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Foot Locker falls short of our quality standards. Following its recent outperformance amid a softer market environment, the stock trades at 13.9× forward P/E (or $24.01 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. We’d suggest looking at one of our top digital advertising picks.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.