CVS Health has had an impressive run over the past six months as its shares have beaten the S&P 500 by 11.4%. The stock now trades at $65.60, marking a 15.2% gain. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy CVS Health, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

We’re glad investors have benefited from the price increase, but we're cautious about CVS Health. Here are three reasons why you should be careful with CVS and a stock we'd rather own.

Why Is CVS Health Not Exciting?

Founded in 1963 as a chain of health and beauty stores, CVS Health (NYSE:CVS) is best known for its retail pharmacies today, but the company also has a health insurance arm (Aetna), and a pharmacy benefits management service as well.

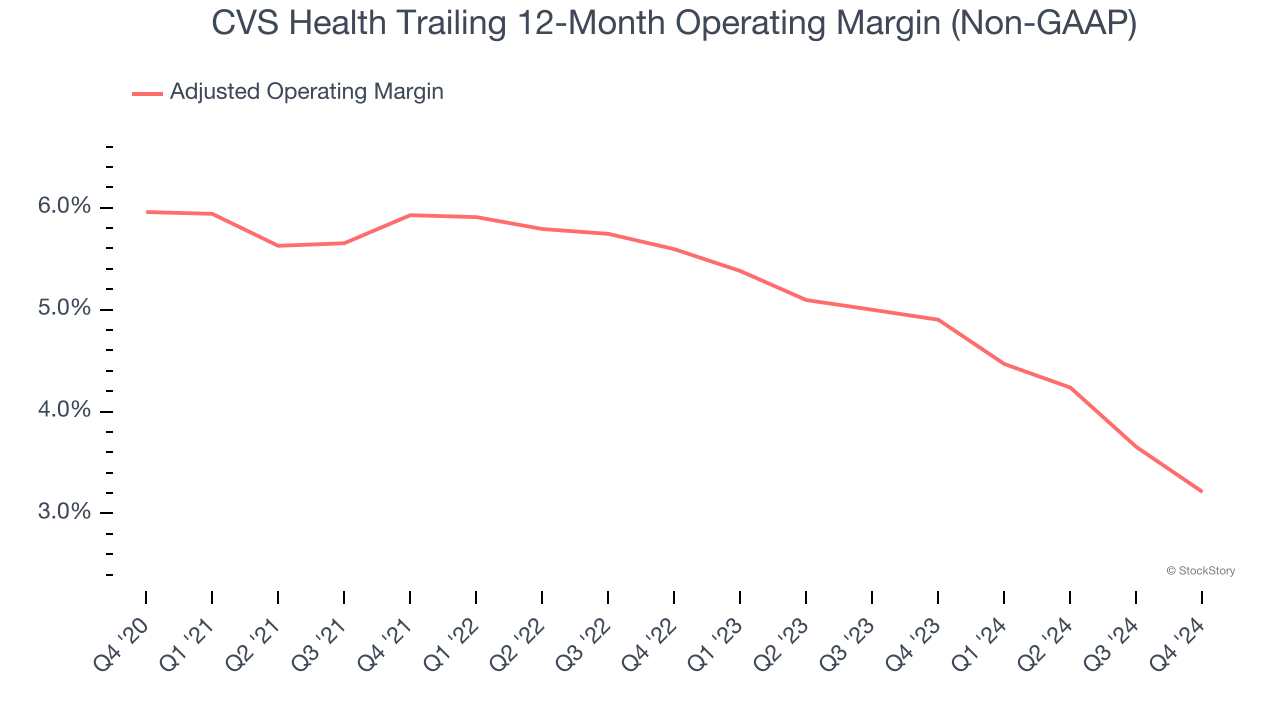

1. Shrinking Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Analyzing the trend in its profitability, CVS Health’s adjusted operating margin decreased by 2.7 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. . CVS Health’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its adjusted operating margin for the trailing 12 months was 3.2%.

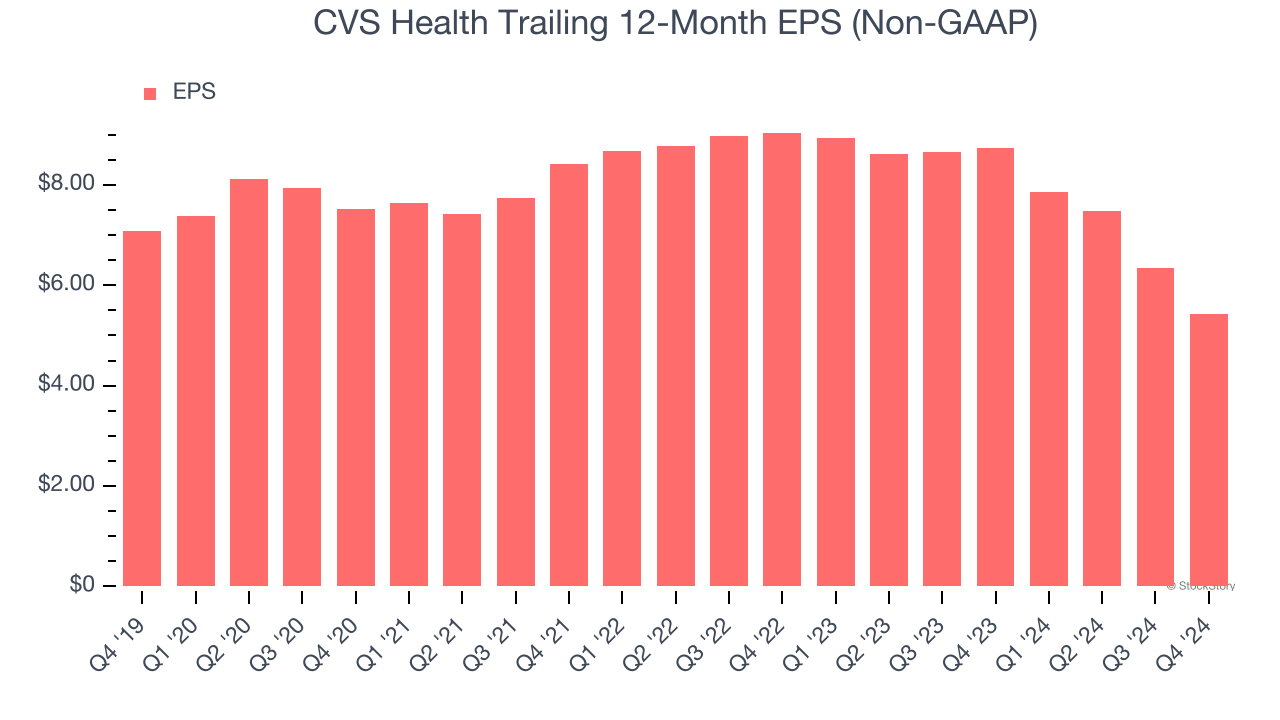

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for CVS Health, its EPS declined by 5.2% annually over the last five years while its revenue grew by 7.7%. This tells us the company became less profitable on a per-share basis as it expanded.

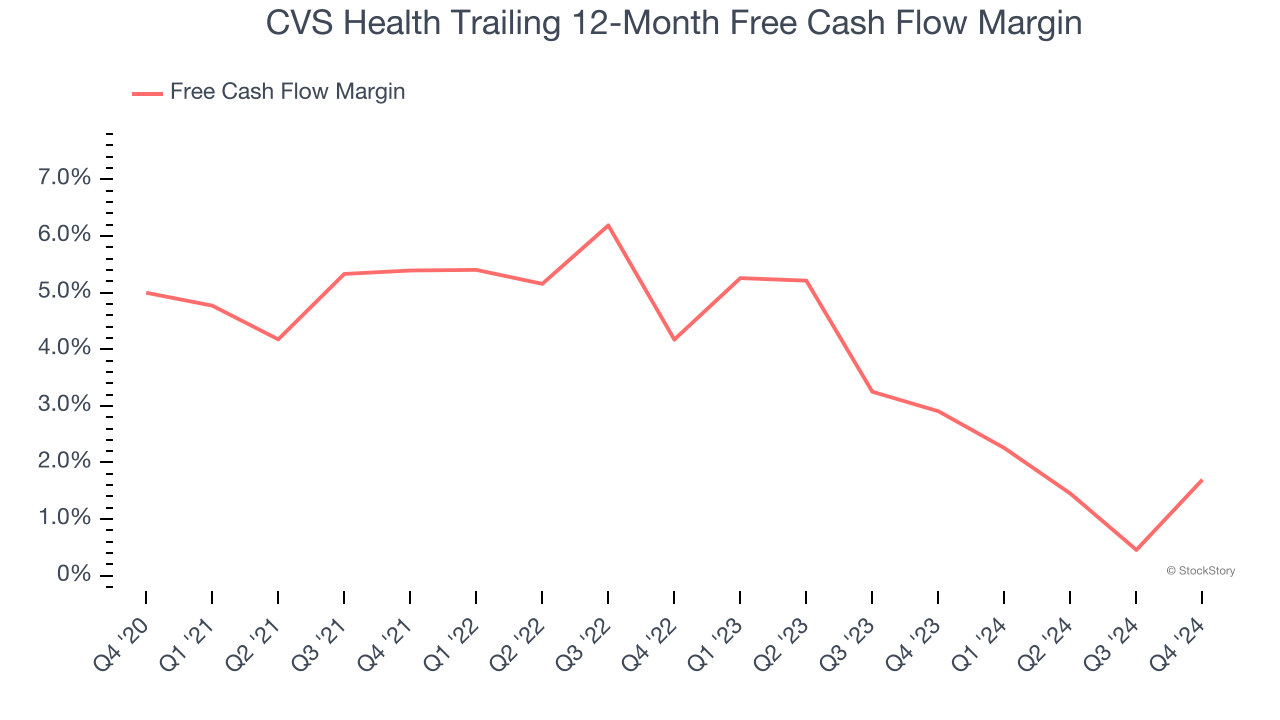

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, CVS Health’s margin dropped by 3.3 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s in the middle of an investment cycle. CVS Health’s free cash flow margin for the trailing 12 months was 1.7%.

Final Judgment

CVS Health isn’t a terrible business, but it isn’t one of our picks. With its shares beating the market recently, the stock trades at 11.2× forward price-to-earnings (or $65.60 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at one of our top software and edge computing picks.

Stocks We Would Buy Instead of CVS Health

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.