As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the thrifts & mortgage finance industry, including PennyMac Mortgage Investment Trust (NYSE:PMT) and its peers.

Thrifts & Mortgage Finance institutions operate by accepting deposits and extending loans primarily for residential mortgages, earning revenue through interest rate spreads (difference between lending rates and borrowing costs) and origination fees. The industry benefits from demographic tailwinds as millennials enter prime homebuying age, technological advancements streamlining the loan approval process, and potential interest rate stabilization improving affordability. However, significant headwinds include net interest margin compression during rate volatility, increased competition from fintech disruptors offering digital-first experiences, mounting regulatory compliance costs, and potential housing market corrections that could impact loan portfolios and default rates.

The 19 thrifts & mortgage finance stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 26.9% while next quarter’s revenue guidance was 1.7% above.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

PennyMac Mortgage Investment Trust (NYSE:PMT)

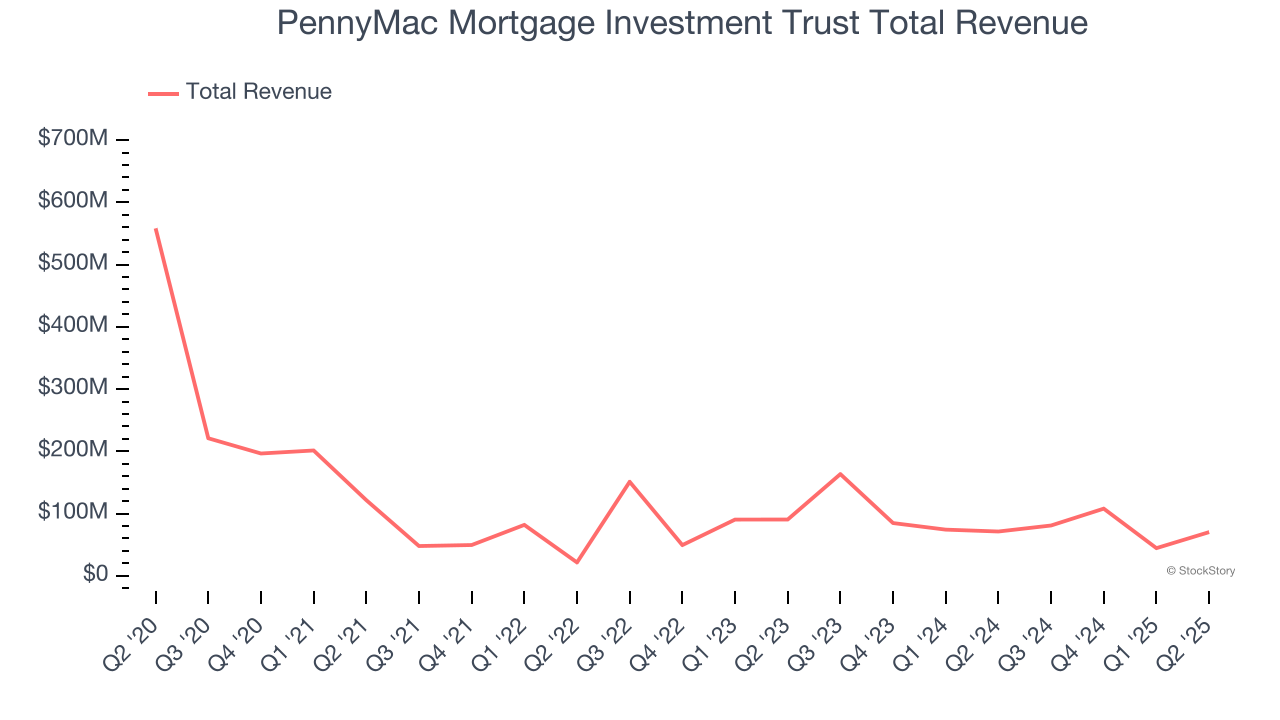

Operating as a real estate investment trust since 2009 to maintain tax advantages, PennyMac Mortgage Investment Trust (NYSE:PMT) is a specialty finance company that invests in mortgage-related assets and operates a correspondent lending business.

PennyMac Mortgage Investment Trust reported revenues of $70.2 million, down 1.4% year on year. This print fell short of analysts’ expectations by 26.1%. Overall, it was a softer quarter for the company with a significant miss of analysts’ revenue and EPS estimates.

“PMT produced solid levels of income excluding market-driven value changes in the second quarter,” said Chairman and CEO David Spector.

Unsurprisingly, the stock is down 6.6% since reporting and currently trades at $11.85.

Read our full report on PennyMac Mortgage Investment Trust here, it’s free for active Edge members.

Best Q2: Ellington Financial (NYSE:EFC)

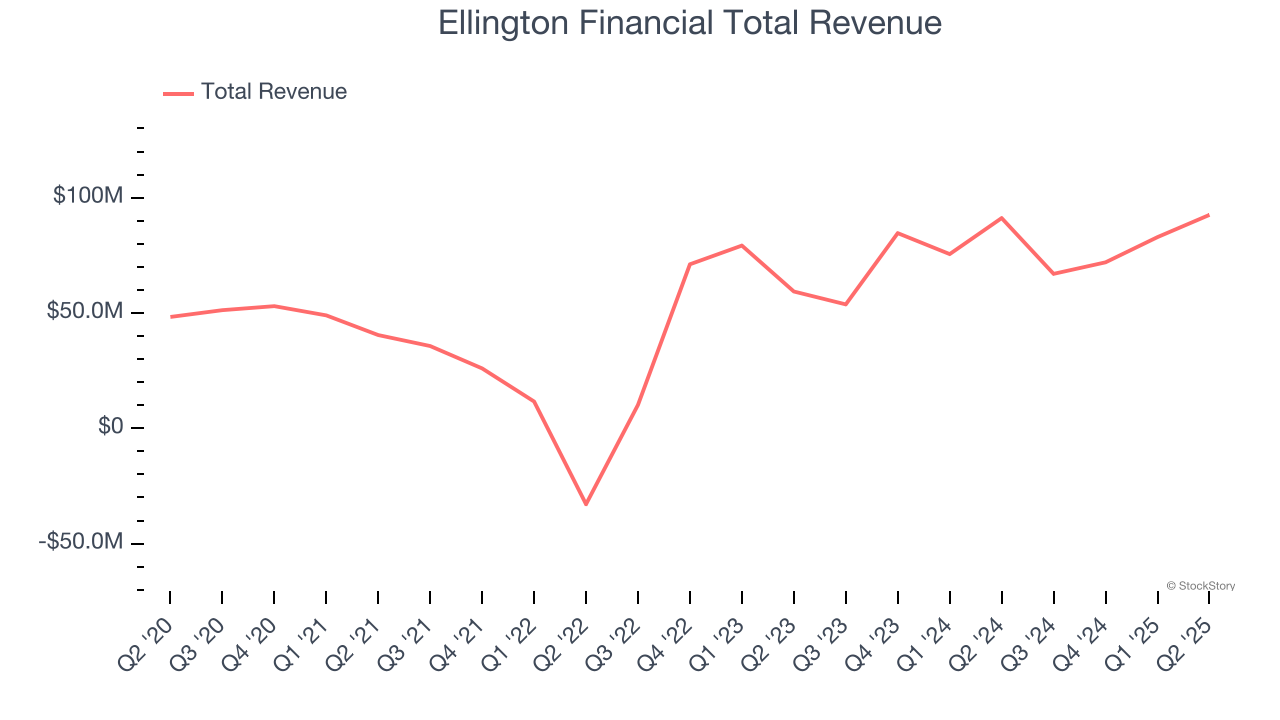

Operating under the guidance of Ellington Management Group, a respected name in structured credit markets, Ellington Financial (NYSE:EFC) acquires and manages a diverse portfolio of mortgage-related, consumer-related, and other financial assets to generate returns for investors.

Ellington Financial reported revenues of $92.54 million, up 1.5% year on year, outperforming analysts’ expectations by 11.5%. The business had a stunning quarter with a solid beat of analysts’ revenue estimates and an impressive beat of analysts’ tangible book value per share estimates.

The market seems happy with the results as the stock is up 6.6% since reporting. It currently trades at $13.50.

Is now the time to buy Ellington Financial? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Ready Capital (NYSE:RC)

Operating as one of only 17 non-bank Small Business Lending Companies with preferred lender status from the SBA, Ready Capital (NYSE:RC) is a multi-strategy real estate finance company that originates, acquires, and services commercial real estate loans, small business loans, and other real estate investments.

Ready Capital reported revenues of -$26.37 million, up 29.4% year on year, falling short of analysts’ expectations by 155%. It was a disappointing quarter as it posted a significant miss of analysts’ tangible book value per share and revenue estimates.

Ready Capital delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 20.1% since the results and currently trades at $3.39.

Read our full analysis of Ready Capital’s results here.

Ladder Capital (NYSE:LADR)

Founded during the 2008 financial crisis when traditional lenders retreated from commercial real estate, Ladder Capital (NYSE:LADR) is a real estate investment trust that originates commercial real estate loans, owns commercial properties, and invests in real estate securities.

Ladder Capital reported revenues of $56.3 million, down 21.4% year on year. This print met analysts’ expectations. Taking a step back, it was a softer quarter as it logged a significant miss of analysts’ tangible book value per share and net interest income estimates.

The stock is down 4.3% since reporting and currently trades at $10.63.

Read our full, actionable report on Ladder Capital here, it’s free for active Edge members.

Franklin BSP Realty Trust (NYSE:FBRT)

Operating as a specialized real estate investment trust (REIT) with roots dating back to 2012, Franklin BSP Realty Trust (NYSE:FBRT) originates and manages a diversified portfolio of commercial real estate debt investments secured by properties in the United States and abroad.

Franklin BSP Realty Trust reported revenues of $50.78 million, up 171% year on year. This result missed analysts’ expectations by 8.9%. It was a disappointing quarter as it also logged a significant miss of analysts’ revenue and net interest income estimates.

Franklin BSP Realty Trust scored the fastest revenue growth among its peers. The stock is up 5.7% since reporting and currently trades at $10.67.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.