If you want a reliable, low-stress stream of income from your investments, Dividend Aristocrats are worth considering. These are S&P 500 ($SPX) companies that have increased their dividend payouts every year for a minimum of 25 consecutive years. This long track record of rising dividends signals strong financial health, steady cash generation, and a focus on delivering long-term value to shareholders.

These dividend stocks are primarily large-cap businesses with durable competitive positions. They have demonstrated an ability to navigate multiple economic cycles while continuing to reward shareholders. Even during periods of market stress or economic slowdown, these companies have maintained and increased their dividend payments. This resilience makes them attractive to investors seeking stability and predictable passive income.

Within this group, Altria (MO) and Realty Income (O) stand out due to their relatively high dividend yields. Moreover, both these companies have the potential for continued dividend growth in the years ahead.

Dividend Aristocrat #1: Altria (MO)

Altria is a compelling high-yield dividend stock to consider. With a forward yield of roughly 7.7%, the stock offers one of the most attractive payouts among large-cap U.S. equities, backed by decades of consistent dividend growth and sustainable payouts. In addition, the tobacco giant’s visibility into future earnings and dividend growth makes it a reliable passive income stock.

Altria increased its quarterly dividend per share by 3.9% to $1.06 last year. This marked the 60th dividend increase in 56 years, reflecting the company’s commitment to returning capital to shareholders. Moreover, it also shows the resilience of its business model, designed to generate steady earnings and cash flow across economic cycles.

Altria’s core smokeable products remain the primary profit engine, with strong net price realization expected to offset ongoing volume declines. This pricing power, combined with continued cost discipline, allows the company to defend margins and maintain steady earnings. At the same time, Altria is investing in smoke-free alternatives, positioning the business for gradual shifts in consumer preferences and long-term relevance.

Overall, its diversified revenue, pricing power, and focus on operational efficiency augur well for future earnings and dividend growth. Altria’s management projects mid-single-digit growth in adjusted diluted earnings per share through 2028. Its growing earnings will enable the company to increase its dividend in line with EPS growth.

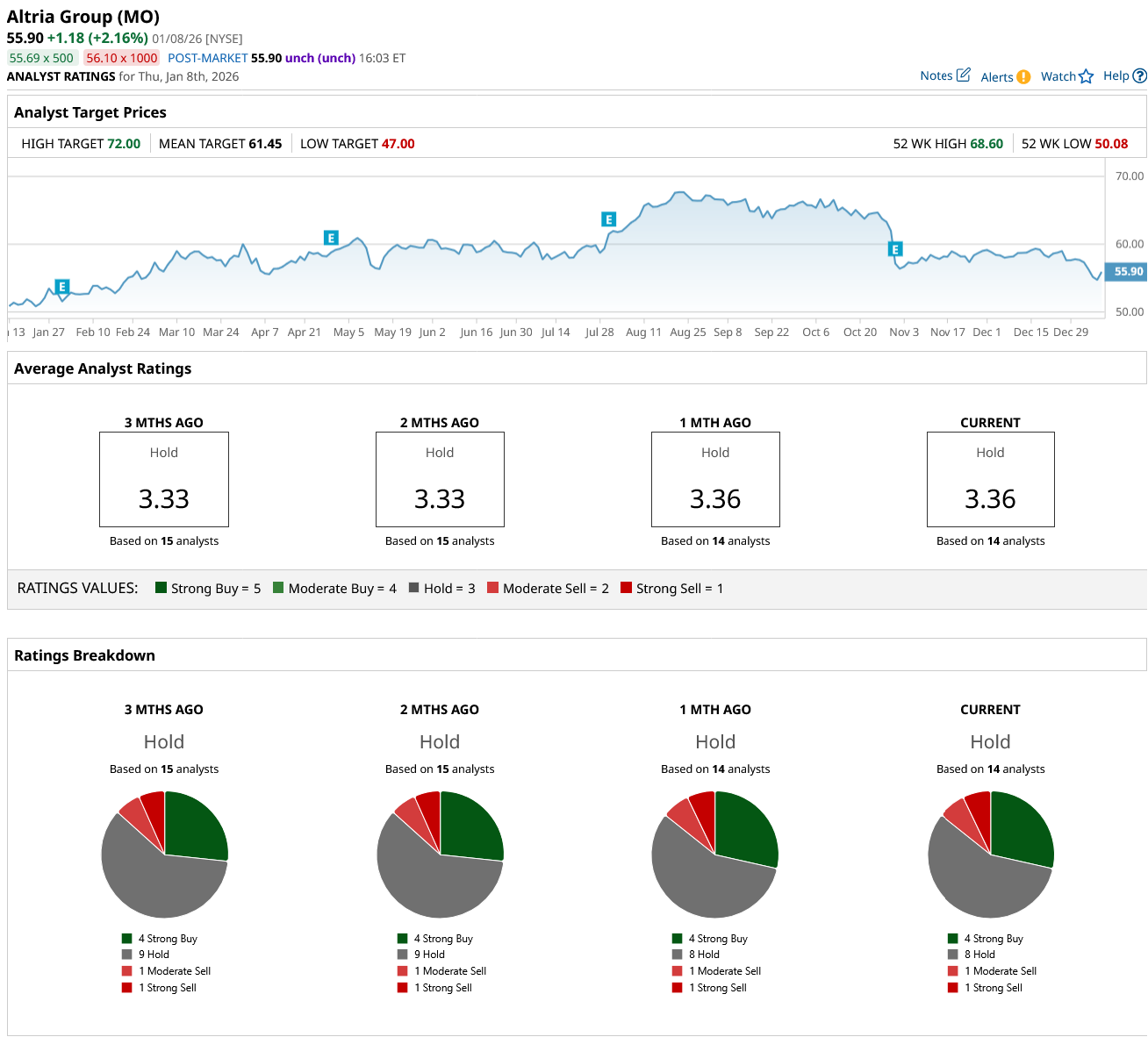

While Wall Street maintains a cautious “Hold” rating due to regulatory pressures and declining cigarette volumes, Altria’s high yield, proven dividend growth record, and resilient earnings profile continue to make it an appealing choice for income-oriented investors.

Dividend Aristocrat #2: Realty Income (O)

Realty Income is a must-have stock for stress-free income. Since its public listing, the real estate investment trust (REIT) has raised its dividend 133 times, extending its streak of annual increases to three decades. It currently pays a monthly dividend of $0.27 per share, or $3.24 annually, translating into an attractive yield of roughly 5.7%.

Supporting its payouts is its highly diversified portfolio of 15,542 commercial properties. Realty Income spreads its investments across property types, tenants, and geographic regions, reducing dependence on any single source of rent. This diversification drives stable cash flows and enhances the company’s ability to sustain dividends across economic cycles.

The REIT’s tenant base is another key strength. Realty Income focuses on high-quality tenants and long-term leases. Moreover, its cost-efficient property management further strengthens its income potential.

Its operational performance remains strong. The REIT’s portfolio has been largely insulated from credit losses, highlighting the financial strength of its tenants. Occupancy stood at 98.7% at the end of the third quarter of 2025, while rent recapture exceeded 100%, indicating the REIT’s ability to renew leases on favorable terms.

Beyond the U.S., Realty Income continues to expand its presence in Europe, diversifying its portfolio and adding new growth opportunities. This international exposure helps balance country-specific risks while supporting long-term income generation.

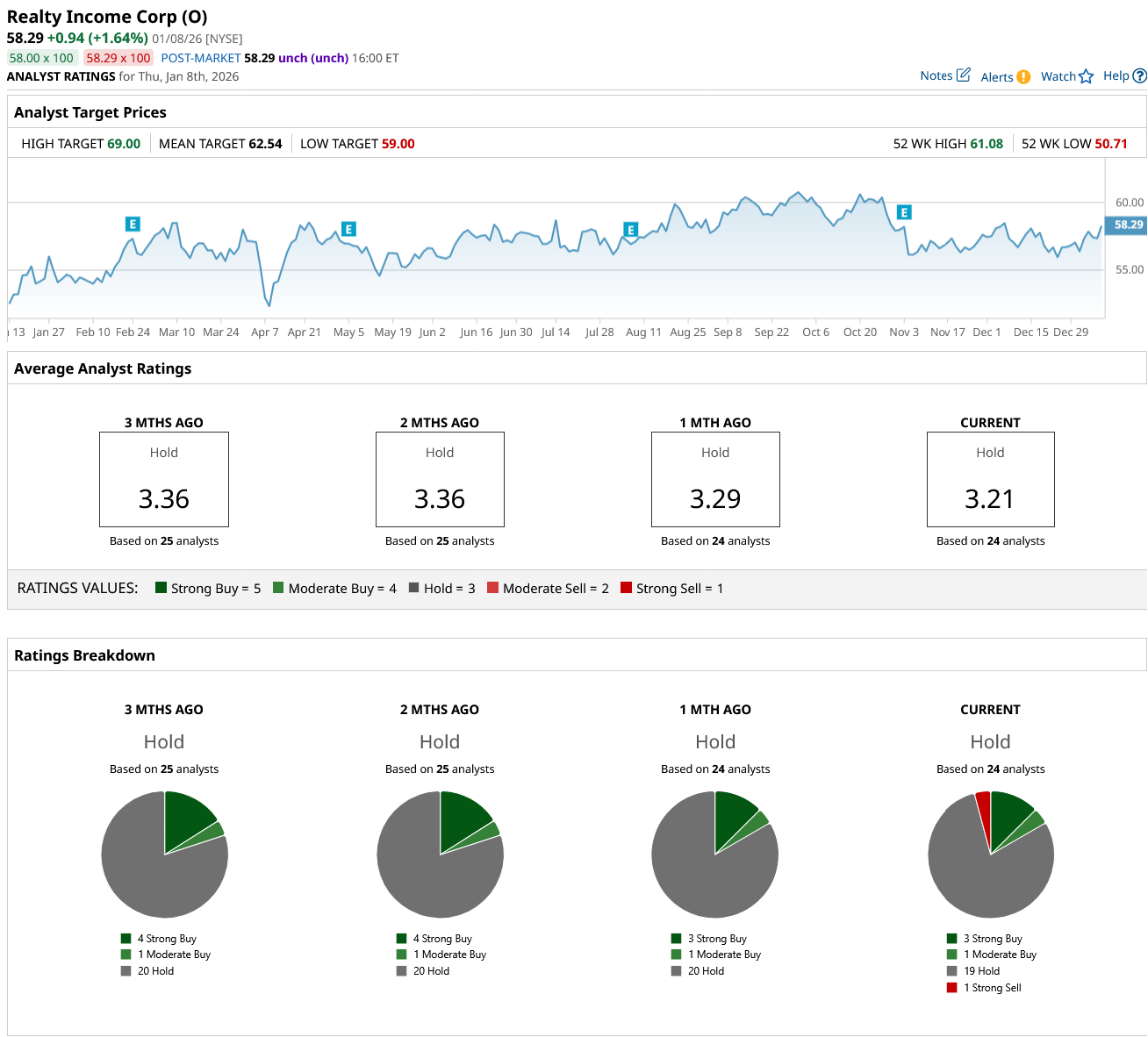

While the stock carries a “Moderate Buy” consensus rating, Realty Income remains an attractive stock for investors seeking high yield and steady passive income in the long term.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart